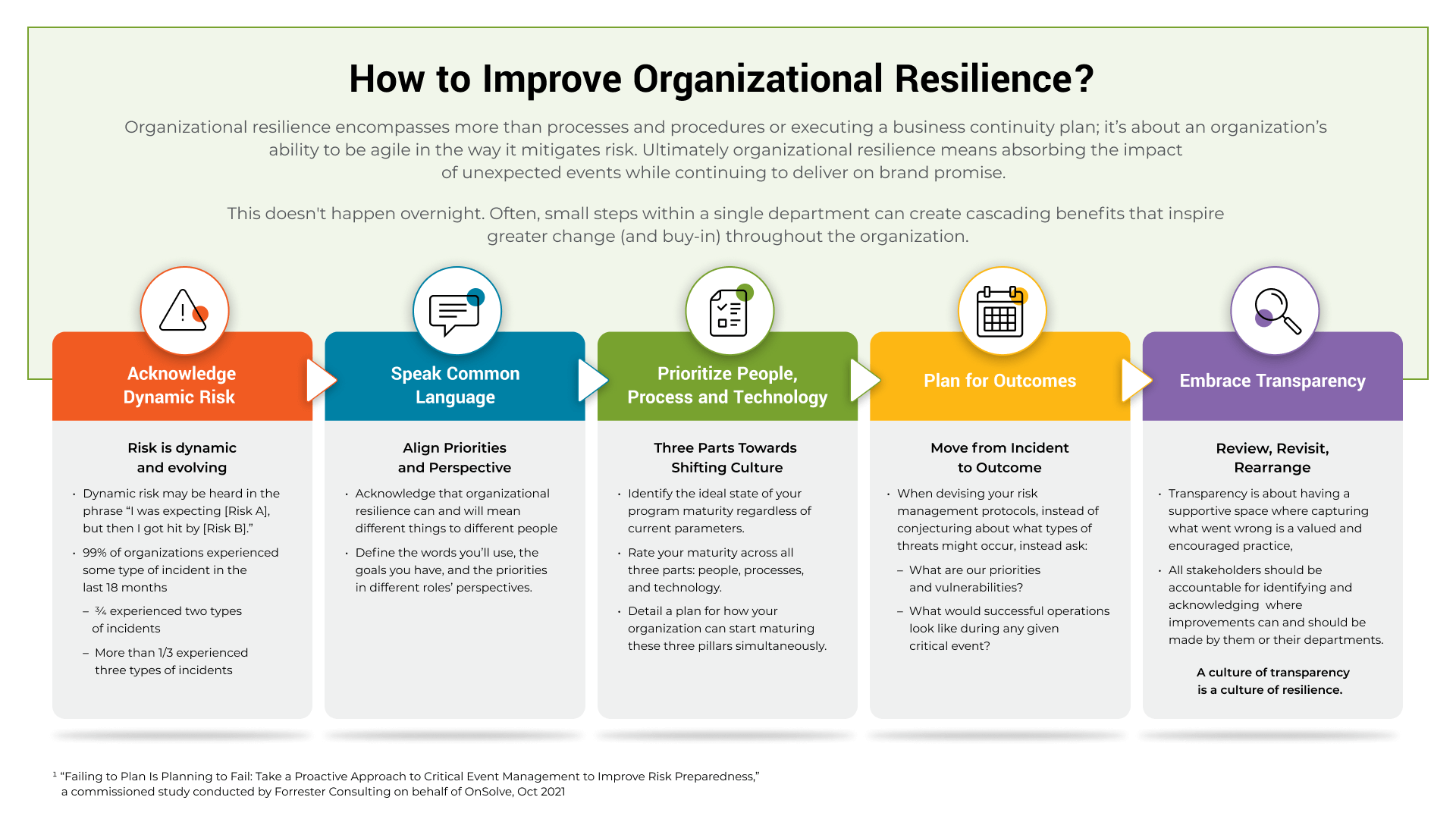

In the dynamic and unpredictable landscape of modern business, the ability of organizations to withstand challenges, adapt to change, and emerge stronger defines the concept of organizational resilience. This resilience is multifaceted, comprising people resilience, reputational resilience, operational resilience, financial resilience, and environmental resilience. In addition, the integration of Environmental, Social, and Governance (ESG) considerations has become a cornerstone of organizational excellence, aligning corporate strategies with sustainable and responsible practices. In this article, we will explore each facet of resilience, drawing insights from real-life examples of companies that exemplify resilience across these dimensions, with a special focus on the principles of ESG.

People Resilience:

People resilience is the ability of an organization to support and empower its workforce, ensuring they remain adaptable and engaged in the face of adversity. Companies that invest in employee well-being, professional development, and create a supportive culture showcase people resilience.

Example: Microsoft

Microsoft has demonstrated people resilience by fostering a culture of continuous learning and adaptability. The company encourages employees to acquire new skills and adapt to evolving technologies. During the COVID-19 pandemic, Microsoft facilitated remote work seamlessly, prioritizing employee safety and well-being.

Developing People Resilience:

- Invest in Training and Development: Provide ongoing training programs that empower employees to acquire new skills and stay relevant in rapidly changing industries.

- Cultivate a Supportive Culture: Foster an environment where employees feel supported, valued, and encouraged to share their concerns and ideas.

- Flexible Work Policies: Implement flexible work policies to support work-life balance, especially during challenging times.

Reputational Resilience:

Reputational resilience involves the capacity to maintain trust and credibility, especially during crises. Companies with strong reputational resilience can weather storms without experiencing severe and lasting damage to their brand image.

Example: Johnson & Johnson

Johnson & Johnson exhibited reputational resilience during the Tylenol crisis in the 1980s. In response to tampered products resulting in deaths, the company took swift action by recalling and redesigning its packaging. This transparent and responsible approach not only saved lives but also solidified the company’s commitment to consumer safety.

Developing Reputational Resilience:

- Communication Strategy: Develop a robust communication strategy that prioritizes transparency and openness during crises.

- Social Responsibility: Engage in socially responsible initiatives that demonstrate a commitment to ethical business practices.

- Customer Relationship Management: Build strong relationships with customers through excellent customer service and responsiveness.

Operational Resilience:

Operational resilience is the ability to sustain essential functions and deliver products or services, even in the face of disruptions. It involves robust business continuity planning and the capability to adapt operations swiftly.

Example: Amazon

Amazon’s operational resilience is evident in its ability to adapt to surges in demand, as seen during peak shopping seasons or the challenges posed by the COVID-19 pandemic. The company’s sophisticated supply chain management and investment in technology enable it to maintain operational continuity, ensuring timely deliveries to customers.

Developing Operational Resilience:

- Business Continuity Planning: Develop comprehensive business continuity plans that account for various scenarios, including pandemics, natural disasters, and supply chain disruptions.

- Invest in Technology: Leverage technology to automate processes, enhance supply chain visibility, and enable remote operations.

- Cross-Training: Cross-train employees to perform multiple roles, ensuring operational flexibility during staff shortages or disruptions.

Financial Resilience:

Financial resilience is an organization’s ability to withstand financial shocks, manage risks effectively, and remain financially viable in the long term.

Example: Toyota

Toyota demonstrated financial resilience during the global financial crisis in 2008. While many automotive companies faced severe setbacks, Toyota’s conservative financial practices, focus on cost efficiency, and diversified product portfolio helped it weather the storm. The company rebounded more swiftly than its counterparts.

Developing Financial Resilience:

- Diversification: Diversify revenue streams and product offerings to reduce dependence on specific markets or products.

- Risk Management: Implement robust risk management strategies that identify and mitigate financial risks.

- Cost Efficiency: Continuously evaluate and optimize operational costs to maintain financial stability.

Environmental Resilience:

Environmental resilience refers to an organization’s ability to adapt to and mitigate the impact of environmental changes, such as climate-related events or regulatory shifts.

Example: Unilever

Unilever exemplifies environmental resilience through its Sustainable Living Plan. The company has committed to reducing its environmental footprint, promoting sustainable sourcing, and fostering a circular economy. This proactive stance not only aligns with global sustainability goals but also positions Unilever as a resilient and responsible corporate citizen.

Developing Environmental Resilience:

- Sustainability Initiatives: Implement sustainability initiatives that align with environmental best practices and regulations.

- Supply Chain Sustainability: Evaluate and enhance the sustainability of the supply chain to reduce environmental impact.

- Regulatory Compliance: Stay abreast of and comply with evolving environmental regulations to minimize business risks.

ESG Excellence:

ESG refers to the three central factors in measuring the sustainability and societal impact of an investment or business: Environmental, Social, and Governance. Companies that prioritize ESG considerations demonstrate a commitment to responsible and ethical business practices.

Example: Unilever (Continued)

Unilever’s commitment to ESG is not limited to environmental sustainability. The company also focuses on social responsibility and governance. Unilever has set ambitious goals for social impact, including improving livelihoods, promoting diversity and inclusion, and enhancing corporate governance practices.

Developing ESG Excellence:

- Environmental Stewardship:

- Implement sustainable practices in energy consumption, waste reduction, and resource management.

- Set clear goals for reducing carbon emissions and improving environmental impact.

- Social Responsibility:

- Invest in community engagement and social impact initiatives.

- Promote diversity and inclusion within the organization and supply chain.

- Governance Practices:

- Establish transparent governance structures and ethical business practices.

- Prioritize accountability, fairness, and integrity in decision-making processes.

Integrating Resilience and ESG Across Dimensions:

While these facets of resilience and ESG considerations are distinct, they are interconnected and collectively contribute to an organization’s overall sustainability and resilience. For instance, a company with strong operational resilience and ESG practices can better navigate financial challenges and reputational risks.

Developing Comprehensive Resilience and ESG Practices:

- Cross-Functional Collaboration: Foster collaboration among different departments to ensure a holistic approach to resilience and ESG integration.

- Continuous Improvement: Establish a culture of continuous improvement, where lessons learned from challenges and ESG initiatives are used to refine and strengthen strategies.

- Scenario Planning: Conduct scenario planning exercises to anticipate potential challenges and prepare effective responses, considering ESG implications.

Conclusion:

Organizational resilience, coupled with a commitment to ESG principles, is not a static attribute; it is a capability that organizations can actively develop and enhance. By investing in people, bolstering reputational strength, fortifying operations, ensuring financial stability, embracing environmental responsibility, and integrating ESG considerations, organizations can navigate storms and shape their futures responsibly.

In the face of unprecedented challenges, resilient and ESG-focused organizations not only survive but thrive. They use crises as catalysts for positive change, adapt to new realities, and emerge stronger, shaping the future of industries and setting benchmarks for others to follow. As the business landscape continues to evolve, the importance of organizational resilience and ESG excellence remains a constant, guiding companies through storms and enabling them to build a sustainable and prosperous future.