Mergers and acquisitions (M&A) are like intricate dances between companies, a fusion of strategies, resources, and, perhaps most importantly, cultures. Navigating the delicate art of cultural integration is a key element in the success of these corporate unions. In this article, we’ll explore the challenges, strategies, and real-world examples that illuminate the path to seamless cultural integration in M&A.

The Dance Floor: Challenges in Cultural Integration

Picture two companies stepping onto the merger dance floor, each with its unique rhythm, values, and traditions. The clash of these cultural differences can create discord, affecting employee morale, productivity, and the overall success of the merger. The challenges are diverse, from communication breakdowns to resistance to change and the potential loss of key talent.

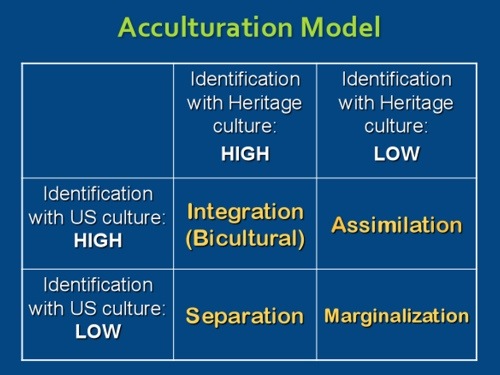

Berry’s Acculturation Model distinguishes between the cultural groups involved in the merger, defining the integration process as a combination of both cultures. The challenges on the dance floor, representing the clash of cultural differences, are well explained by Berry’s model, emphasizing the need for a balanced integration that respects the values of both organizations (US Culture Versus Heritage Culture).

Choreographing Success: Strategies for Cultural Integration

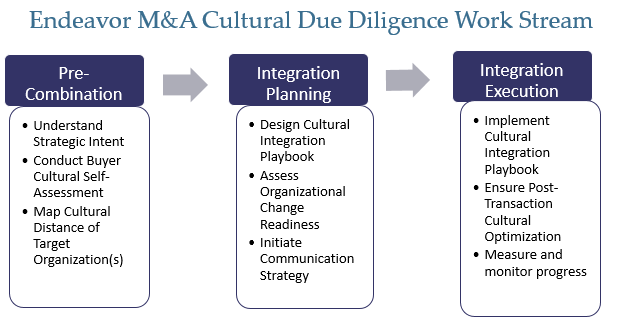

- Early Assessment and Planning:

- Example: Bayer and Monsanto – Before their merger, Bayer and Monsanto engaged in extensive cultural due diligence. Understanding each other’s values, they developed a roadmap for integration that addressed potential clashes and synergies.

- Leadership Alignment:

- Example: Disney and Pixar – When Disney acquired Pixar, the leadership of both companies worked closely to align their visions. The result was a collaborative culture that fostered creativity and innovation, preserving what made each company unique.

- Communication is Key:

- Example: AOL and Time Warner – The failure of this merger is often attributed to a lack of effective communication. Lessons learned from this experience emphasize the importance of transparent and ongoing communication to build trust among employees.

- Employee Involvement:

- Example: Cisco and AppDynamics – Cisco involved employees in the integration process after acquiring AppDynamics. The focus on open dialogue and collaboration helped ease the transition and build a cohesive culture.

- Preserving What Works:

- Example: Amazon and Zappos – Amazon’s acquisition of Zappos allowed the latter to maintain its unique company culture. Amazon recognized the value of Zappos’ distinct approach to customer service and retained it post-acquisition.

A Symphony of Success: Real-World Cultural Integration Triumphs

- Microsoft and LinkedIn:

- Microsoft’s acquisition of LinkedIn in 2016 is considered a success story. By respecting and integrating LinkedIn’s innovative culture, Microsoft bolstered its presence in the professional networking space while retaining the essence of what made LinkedIn unique.

- AT&T and WarnerMedia:

- In the AT&T and WarnerMedia merger, a focus on shared values and a commitment to creativity has allowed the companies to leverage each other’s strengths. The integration process has been marked by collaborative projects that showcase the synergy of their combined talents.

The Grand Finale: Continuous Evaluation and Evolution

Cultural integration in M&A is not a one-time performance but an ongoing process. Companies must be vigilant, continuously evaluating and evolving their strategies to adapt to the changing dynamics of their combined workforce.

Conclusion:

Cultural integration in mergers and acquisitions is a delicate dance that requires careful planning, open communication, and a commitment to preserving the best of both worlds. As witnessed in the success stories of Microsoft and LinkedIn or AT&T and WarnerMedia, the art of merging cultures is not just about avoiding clashes; it’s about creating a symphony where the combined strengths of both organizations harmonize into something greater than the sum of its parts. In the corporate ballroom, cultural integration isn’t just a necessity – it’s the choreography that transforms M&A into a seamless, successful performance.