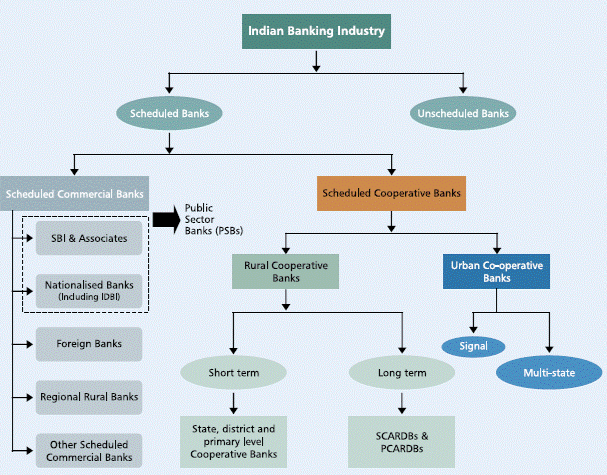

India’s financial landscape is a vibrant tapestry, woven with diverse segments, including Banking, Financial Services, Insurance (BFSI), Non-Banking Financial Companies (NBFCs), Fintech, and various ancillary services. In this extensive exploration, we delve into the intricacies of each sector, spotlighting the top companies, services, financial products, and the vital skills required in this dynamic ecosystem.

I. Banking Segment:

Top Companies: State Bank of India (SBI), HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank

- State Bank of India (SBI):

- SBI remains the bedrock of India’s banking sector, offering a plethora of services, from retail banking to international banking. It boasts an extensive branch network and digital services, making it a cornerstone for financial inclusion.

- HDFC Bank:

- HDFC Bank is a trailblazer in digital banking, known for its innovation and customer-centric approach. The bank provides a wide range of services, including savings accounts, loans, credit cards, and investment products.

- ICICI Bank:

- ICICI Bank, a pioneer in private banking, stands out for its diversified product portfolio, encompassing retail and corporate banking, wealth management, and innovative digital solutions.

- Axis Bank:

- Axis Bank focuses on a spectrum of services, including retail and corporate banking, treasury operations, and a robust digital presence. It has emerged as a leader in embracing technology for seamless customer experiences.

- Kotak Mahindra Bank:

- Kotak Mahindra Bank is known for personalized banking services and has a strong foothold in wealth management and investment banking. Its customer-centric approach and innovative solutions set it apart in the industry.

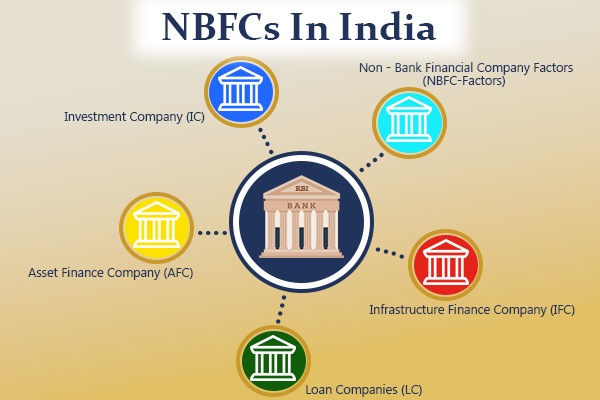

II. Non-Banking Financial Companies (NBFCs):

Top Companies: Bajaj Finance, Mahindra Finance, Indiabulls Housing Finance, L&T Finance, Aditya Birla Finance

- Bajaj Finance:

- Bajaj Finance, a leading NBFC, offers diverse financial products, including consumer loans, personal loans, and business loans. Its customer-focused approach and quick processing have made it a preferred choice.

- Mahindra Finance:

- Mahindra Finance specializes in rural and agricultural finance, providing services such as tractor loans, vehicle loans, and rural housing finance. It plays a crucial role in financial inclusion in rural India.

- Indiabulls Housing Finance:

- Indiabulls Housing Finance operates in the housing finance sector, offering home loans, loan against property, and other real estate financing solutions. It contributes significantly to the real estate ecosystem.

- L&T Finance:

- L&T Finance is known for its diverse financial offerings, spanning infrastructure finance, rural finance, and housing finance. Its focus on sustainable growth and risk management sets it apart.

- Aditya Birla Finance:

- Aditya Birla Finance provides a wide range of financial solutions, including corporate finance, structured finance, and wealth management. Its emphasis on financial prudence and customer satisfaction is noteworthy.

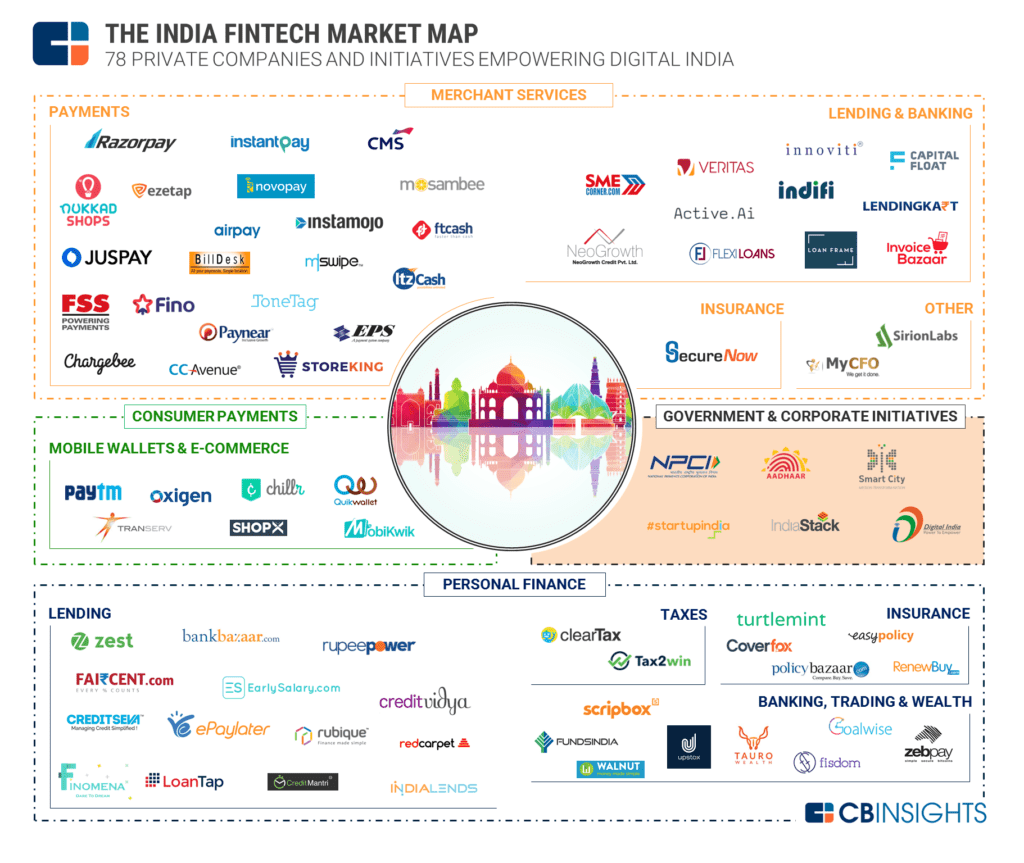

III. Fintech:

Top Companies: Paytm, PhonePe, Razorpay, PolicyBazaar, Zerodha

- Paytm:

- Paytm is a leading fintech company offering a comprehensive suite of services, including digital payments, mobile recharges, and financial products like Paytm Money. Its digital wallet has been instrumental in driving the adoption of digital transactions.

- PhonePe:

- PhonePe, a subsidiary of Flipkart, is a prominent player in the digital payments space. It offers a unified platform for UPI payments, bill payments, and investments, making it a versatile fintech solution.

- Razorpay:

- Razorpay is a fintech company specializing in payment solutions for businesses. It provides a seamless payment gateway, subscription billing, and other financial services, catering to the needs of the evolving e-commerce landscape.

- PolicyBazaar:

- PolicyBazaar is a disruptor in the insurance sector, providing an online platform for comparing and purchasing insurance policies. Its user-friendly interface and comprehensive coverage options have transformed the insurance-buying experience.

- Zerodha:

- Zerodha is a fintech company revolutionizing the brokerage industry. It offers a discount brokerage platform, making stock trading accessible to a broader audience with its user-friendly interface and low-cost structure.

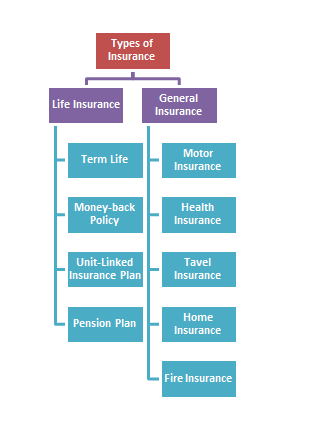

IV. Insurance Segment:

Top Companies: LIC (Life Insurance Corporation), ICICI Prudential Life Insurance, HDFC Life, SBI Life, Max Life Insurance

- LIC (Life Insurance Corporation):

- LIC, a government-owned giant, dominates the life insurance sector, providing a range of life insurance products, pension plans, and investment options. Its pan-India presence and trust factor make it a preferred choice.

- ICICI Prudential Life Insurance:

- ICICI Prudential Life Insurance is a leading private life insurer, known for its diverse life insurance products and innovative investment-linked policies. It combines traditional coverage with modern investment options.

- HDFC Life:

- HDFC Life is a prominent player offering a variety of life insurance plans. Its customer-centric approach, transparent policies, and robust digital services have contributed to its success in the market.

- SBI Life:

- SBI Life is a joint venture between State Bank of India and BNP Paribas Cardif. It offers a comprehensive suite of life insurance products, catering to diverse customer needs. Its strong bancassurance model leverages the vast network of SBI branches.

- Max Life Insurance:

- Max Life Insurance is known for its customer-centric approach and innovative insurance solutions. It has pioneered products that cater to specific customer needs, emphasizing long-term financial planning.

V. Financial Advisory Firms and Brokers:

Top Companies: Edelweiss Wealth Management, Motilal Oswal, Angel Broking, HDFC Securities, IIFL Wealth Management

- Edelweiss Wealth Management:

- Edelweiss offers a range of wealth management services, including investment advisory, portfolio management, and financial planning. Its emphasis on personalized advice and diversified investment options sets it apart.

- Motilal Oswal:

- Motilal Oswal is a prominent player in financial services, offering services like equity and commodity broking, investment banking, and wealth management. Its research-driven approach provides valuable insights to clients.

- Angel Broking:

- Angel Broking is a leading stockbroker with a focus on retail and institutional broking. Its user-friendly trading platforms and robust research capabilities make it a preferred choice for investors.

- HDFC Securities:

- HDFC Securities, a subsidiary of HDFC Bank, provides a wide range of financial services, including equity trading, mutual funds, and fixed deposits. Its strong parentage and technological advancements contribute to its popularity.

- IIFL Wealth Management:

- IIFL Wealth Management is known for its comprehensive wealth management services, catering to high-net-worth individuals. Its personalized approach, investment strategies, and financial planning services distinguish it in the wealth management space.

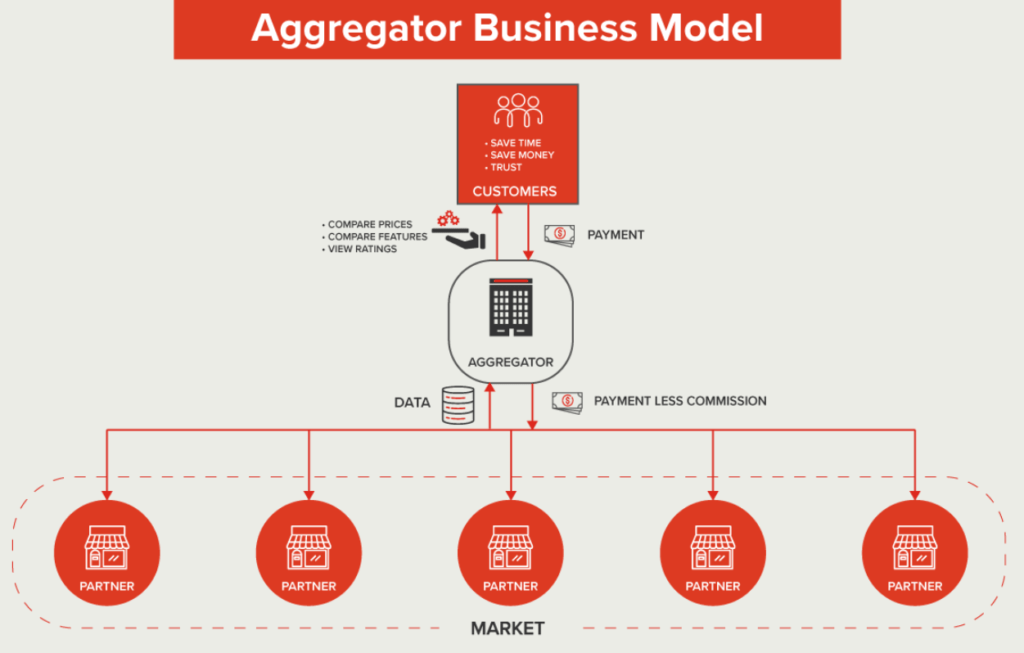

VI. Aggregators and Comparison Platforms:

Top Companies: PolicyBazaar, BankBazaar, Paisabazaar, PolicyX, Policyfy

- PolicyBazaar:

- PolicyBazaar, in addition to being a leading insurer, operates as an aggregator, allowing users to compare and purchase insurance policies from various providers. Its user-friendly platform simplifies the insurance-buying process.

- BankBazaar:

- BankBazaar is a comprehensive financial marketplace offering comparison services for various financial products, including loans, credit cards, and insurance. Its platform simplifies the decision-making process for consumers.

- Paisabazaar:

- Paisabazaar is a financial aggregator providing a platform for users to compare and choose from a variety of financial products, including loans, credit cards, and mutual funds. Its wide array of offerings caters to diverse financial needs.

- PolicyX:

- PolicyX is an online insurance aggregator that enables users to compare and purchase insurance policies. Its focus on simplicity and transparency makes it a popular choice among consumers.

- Policyfy:

- Policyfy is an emerging player in the insurance aggregator space, offering users a platform to compare and buy insurance policies. Its emphasis on a hassle-free experience and personalized recommendations contributes to its growing user base.

VII. Top Skills Required in Each Segment:

- Banking:

- Financial Analysis

- Risk Management

- Customer Relationship Management

- Digital Banking Expertise

- Regulatory Compliance Knowledge

- NBFC:

- Credit Risk Assessment

- Financial Modelling

- Regulatory Compliance

- Relationship Management

- Market Research

- Fintech:

- Software Development (Programming languages like Python, Java)

- Data Analytics

- UX/UI Design

- Digital Marketing

- Blockchain Technology

- Insurance:

- Actuarial Science

- Underwriting Expertise

- Sales and Marketing

- Risk Management

- Customer Service Skills

- Financial Advisory and Brokers:

- Financial Planning

- Market Research and Analysis

- Relationship Management

- Investment Advisory

- Regulatory Compliance

- Aggregators and Comparison Platforms:

- Data Analysis

- Digital Marketing

- Product Knowledge

- User Experience Design

- Business Development

Conclusion:

India’s BFSI landscape is a multifaceted mosaic, constantly evolving to meet the dynamic needs of its diverse population. From traditional banking to disruptive fintech innovations, each segment plays a crucial role in shaping the financial destiny of the nation. As we navigate through the intricacies of banking, insurance, NBFCs, fintech, and allied services, the common thread is the relentless pursuit of innovation, customer-centricity, and adaptability to technological advancements. The future promises continued growth, propelled by the synergy of traditional financial institutions and the agile disruptors, creating a resilient and inclusive financial ecosystem for India.